In an effort to better understand the economic challenges faced by Muslims today, an online survey was conducted to identify the key factors contributing to financial struggles within the community.

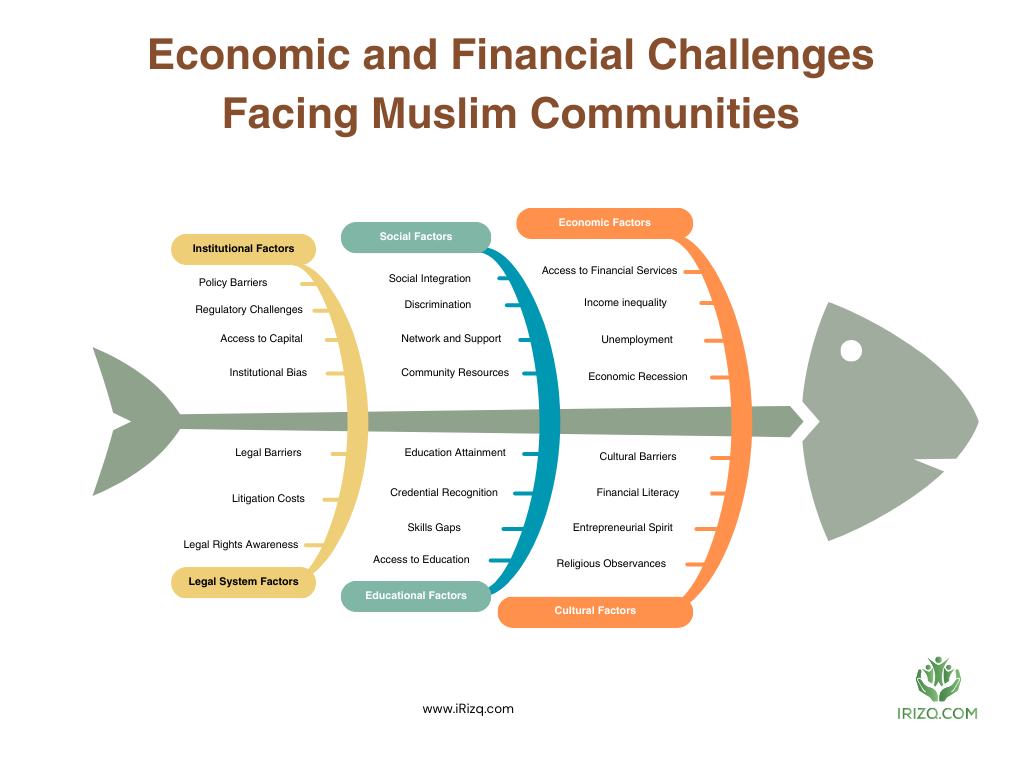

The results were compiled into a fishbone diagram, revealing a complex web of barriers that hinder economic progress. These challenges span across multiple domains, including economic, social, educational, institutional, cultural, and legal factors.

Key Economic Challenges

1. Economic Factors

Economic instability, high unemployment, and income inequality have been significant hurdles for many Muslims. Limited access to financial services and the impact of economic recessions further exacerbate these issues. Without proper financial tools and opportunities, it becomes difficult for individuals and businesses to thrive.

2. Social Factors

Social challenges, such as workplace discrimination, lack of professional networks, and insufficient community resources, play a major role in restricting economic growth. Many Muslims struggle to integrate into wider financial systems due to systemic biases and limited mentorship opportunities.

3. Institutional Barriers

Government policies, regulatory restrictions, and institutional biases often create additional roadblocks. Many Muslim entrepreneurs face difficulties in securing business loans and investment opportunities, largely due to a lack of access to halal capital and financing options that align with Islamic principles.

4. Educational Barriers

Education remains a critical factor in economic mobility. Many individuals face challenges in recognizing their foreign credentials, filling skill gaps, and accessing higher education or specialized training. Without proper education and skill development, it becomes harder to secure stable, well-paying jobs.

5. Cultural Considerations

Cultural and religious factors also play a role in economic decision-making. Some individuals may struggle with balancing religious observances, such as prayer and fasting, with workplace expectations. Additionally, entrepreneurial spirit varies within the community, with some lacking the necessary support or financial literacy to build successful businesses.

6. Legal and Systemic Barriers

Legal status and awareness of rights also impact economic opportunities. Many individuals, particularly immigrants, face difficulties due to legal restrictions or a lack of knowledge about labor rights and business regulations.

Solving What We Can

While addressing every challenge may not be feasible, we can start by focusing on practical and achievable solutions that can significantly improve economic conditions within the Muslim community:

- Access to financial services: Ensuring Muslims have access to ethical banking and financial products that align with Islamic principles.

- Financial literacy: Providing education on money management, investing, and wealth-building strategies.

- Income inequality: Promoting fair wages, advocating for workplace equality, and creating better job opportunities.

- Religious observances: Encouraging workplaces to accommodate religious practices without discrimination.

- Entrepreneurial spirit: Supporting Muslim entrepreneurs with resources, mentorship, and business development opportunities.

- Skills gap: Investing in training programs to equip individuals with in-demand job skills.

- Network and support: Strengthening professional and business networks within the Muslim community.

- Education attainment: Encouraging higher education and vocational training to improve job prospects.

- Community resources: Enhancing local support systems to provide economic guidance and assistance.

- Access to halal capital: Expanding funding options that comply with Islamic finance principles, such as profit-sharing and interest-free loans.

iRizq.com – A Solution for Economic Empowerment

Recognizing the urgent need to address these economic challenges, iRizq.com was created as a direct response to these issues. The platform is dedicated to:

- Providing financial literacy resources to help Muslims make informed decisions about saving, investing, and wealth-building.

- Encouraging entrepreneurship by offering guidance and tools to start and grow successful businesses.

- Offering halal investment education to help individuals build wealth while adhering to Islamic principles.

- Promoting Muslim businesses by giving them visibility and helping them connect with the right audience.

- Creating opportunities to increase the livelihoods of the Ummah, ensuring that Muslims have access to the tools, knowledge, and resources needed to thrive economically.

While solving all challenges may not be possible, we can start with those within our reach. By taking small but significant steps toward financial literacy, entrepreneurship, and community support, we can build a stronger and more self-sufficient Ummah. Visit iRizq.com and be part of the movement to empower Muslim businesses and individuals.